(Bloomberg) — After months of struggles, Apple Inc. looks a lot more like the stock market leader it was.

Most Read by Bloomberg

Shares of the iPhone maker are on pace for their best month since March 2023. They gained nearly 12% after a strong earnings report showed growth was returning and the company also announced the biggest share buyback in history of the United States, a sign of its financial power.

In addition, there is growing excitement about its plans for artificial intelligence. After falling as much as 14% this year, the stock is close to erasing those losses. Shares rose 0.5% on Thursday, on track for their fourth consecutive positive session.

The latest leg of the rally came after a Bloomberg report that Apple was closing in on a deal with OpenAI to use ChatGPT features in the new iPhone operating system. It had more resonance after OpenAI on Monday showed off a faster and cheaper version of the AI model that underpins ChatGPT, including a demonstration of new voice features.

The demonstration showed the potential for AI-inspired digital assistants, and such features could boost Apple’s revenue growth by forcing customers to buy new iPhones and pay for more services, according to Ken Mahoney, chief executive of Mahoney Asset Management. He’s more convinced than ever that “AI will lead to Siri on steroids,” he said.

“A lot of the details of Apple’s AI strategy are still under wraps, but I think AI will lead to a huge upgrade cycle, one of the biggest it’s seen in a while,” Mahoney said.

The agreement with OpenAI is not yet official, and Apple has also held talks with Alphabet Inc. to build Google’s Gemini AI engine into the iPhone. Those talks are ongoing, according to Bloomberg News.

This week, Google unveiled its own new AI features in a demonstration that was seen as a positive sign of its own technological capabilities. Investors suggest that a partnership with the two could be positive for Apple.

Read more: Google Brings Generative AI to Search in Major Update

“You don’t have to build things from scratch or make huge investments in AI just to bring something to market,” Mahoney said. “Other companies have already done this work, and they’re all going to want to be on the iPhone.”

A key event for Apple will come at the Worldwide Developers Conference on June 10. The company is expected to show off its next big software updates for the iPhone and other devices, where the new AI strategy will be front and center, Bloomberg reported.

Apple has been dogged this year by concerns about stagnant revenue growth amid sluggish iPhone sales and weakness in China. Revenue fell 4% in Apple’s fiscal second quarter, the fifth contraction in the past six quarters. However, the Cupertino, Calif.-based company is forecasting sales to increase by a percentage in the low single digits, raising hopes for future expansion.

Of course, there is still plenty of uncertainty, and at 27 times expected earnings, Apple remains above its long-term average in a time of weak growth.

“If Apple can’t regain growth, then it’s probably a bit expensive,” said Ryan Gorman, an independent analyst who was previously chief investment officer at Callesen Wealth Management.

“A deal with OpenAI or Alphabet would show that Apple is taking AI seriously,” he added. AI is a “must have feature to stay relevant, but does it really drive profits and revenue in the future? That remains to be seen.”

Technical chart of the day

Top tech news

-

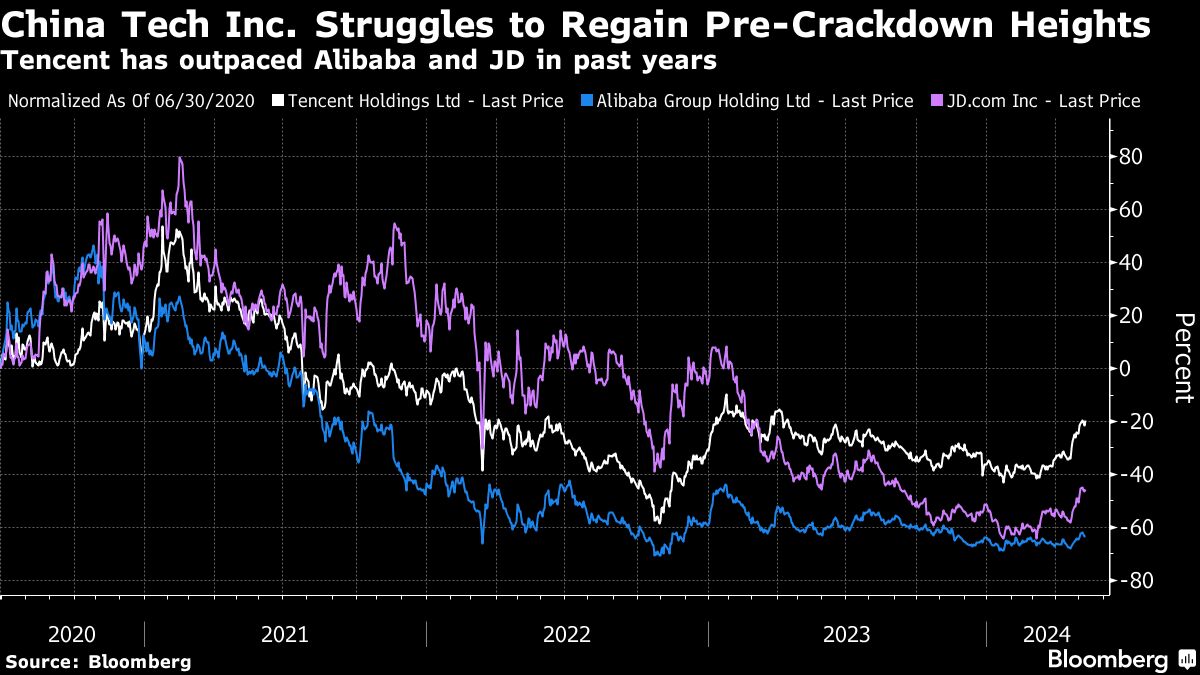

Michael Burry’s investment firm doubled down on its bets on JD.com Inc and Alibaba Group Holding Ltd. in the first quarter as Chinese stocks bottomed out.

-

When Microsoft Corp. pledged four years ago to remove more carbon than it emits by the end of the decade, it was one of the most ambitious and comprehensive plans to tackle climate change. Now, the software giant’s relentless pursuit of being the world leader in artificial intelligence is putting that goal in jeopardy.

-

Five years after Amazon.com Inc. raised wages to $15 an hour, half of the warehouse workers polled by researchers said they had a hard time affording enough food or a place to live.

-

Baidu Inc.’s revenue grew at the slowest pace in more than a year as China’s sluggish economy puts pressure on its core advertising business.

-

ServiceNow Inc. grew its workforce and expanded into enterprise software using a simple strategy: hiring from its larger competitor, Salesforce Inc.

Winnings are due on Thursday

-

Advance market

-

Postmarket

-

Applied materials

-

Globant

-

DXC technology

-

–With assistance from Sarah Zheng and Subrat Patnaik.

(Market updates are open.)

Most Read by Bloomberg Businessweek

©2024 Bloomberg LP