Another stock could turn out to be the biggest winner of the AI chip wars.

Microsoft recently announced that it will offer its cloud computing customers the option to use MI300X artificial intelligence (AI) chips manufactured by Advanced Micro Devices (AMD 3.70%). Microsoft will offer MI300X chip clusters through its Azure cloud service as an alternative to Nvidia‘c (NVDA 2.57%) H100 graphics processing units (GPUs).

Given this announcement, is it time to dump Nvidia stock in favor of AMD?

The simple answer is no. Expanding on this answer, it may be a good time to buy both stocks – and another beneficiary.

Why Microsoft started offering AMD chips

Microsoft is not offering cloud customers the option of AMD GPUs as an upgrade to Nvidia GPUs, which have become the industry standard to help power AI applications in the data center. The problem is that Nvidia’s chips are so popular that it’s becoming increasingly difficult for companies to get their hands on them. That’s not a bad problem to have.

Both Nvidia and AMD are struggling to keep up with demand for their GPUs. Taiwanese semiconductor manufacturing (TSM 1.85%), the world’s largest semiconductor maker, said its advanced packaging capacity is fully booked for the rest of this year and next. This is believed to be due to demand for GPUs from Nvidia and AMD, which are the company’s top 10 customers.

TSCM is working to aggressively expand its manufacturing capacity to meet demand for AI and other high-performance computing (HPC) chips. The company now plans to build a third manufacturing facility (fab) in Arizona, after its first facility in the state just started making wafers. It also just completed its first specialty technology factory in Japan and announced a second in the country to be completed by the end of 2027. It is also building a factory in Germany for automotive and industrial applications, scheduled to begin construction at the end of this year.

TSMC is also looking to fully develop its 2-nanometer chip technology. Within the semiconductor industry, as technology moves to smaller assemblies (semiconductor sizes), more chips can fit on a wafer, increasing production capacity and reducing costs.

However, until this technology and fab expansion takes hold, the GPU market looks set to remain tight.

Image source: Getty Images

Time to buy Nvidia, AMD and TSMC

Instead of dumping Nvidia, now might be a great time for investors to buy shares of Nvidia and AMD, as well as TSMC. The demand for high performance computing chips and GPUs is huge and the industry is currently struggling to meet the demand.

Nvidia remains the clear leader and its growth has been nothing short of impressive. The company long ago became the industry standard for pre-AI GPUs through its CUDA software platform, which allows its GPUs to be programmed directly. At this point, the company can probably sell as many chips as its foundry partners can produce. Nowadays, most semiconductor companies do not own their own manufacturing facilities and instead use contract manufacturers such as TSCM.

AMD, meanwhile, is a good beneficiary of the very tight GPU market. With its first-quarter results, the company just raised its full-year data center GPU revenue forecast from $3.5 billion to $4.0 billion. And with Nvidia GPUs hard to come by, AMD has the opportunity to enter this market and become a viable number two player. Companies generally don’t like to rely too much on one vendor, so current market dynamics could give AMD a longer-term boost if its chips are well received.

TSCM, meanwhile, is a major beneficiary of demand for GPUs and chips as companies race to get those chips to power AI applications. By adding additional fabs and moving to 2-nanometer technology, TSCM is set to take advantage of the AI chip boom. It will also benefit as other companies join it. For example, it was reported that Arm Holdings and Softbank have been looking to design an AI chip while companies like Amazon have also entered the AI chip business. An apple Meanwhile, executives have reportedly met with TSMC to keep 2-nanometer manufacturing to help the company catch up in AI. All of this benefits TSMC.

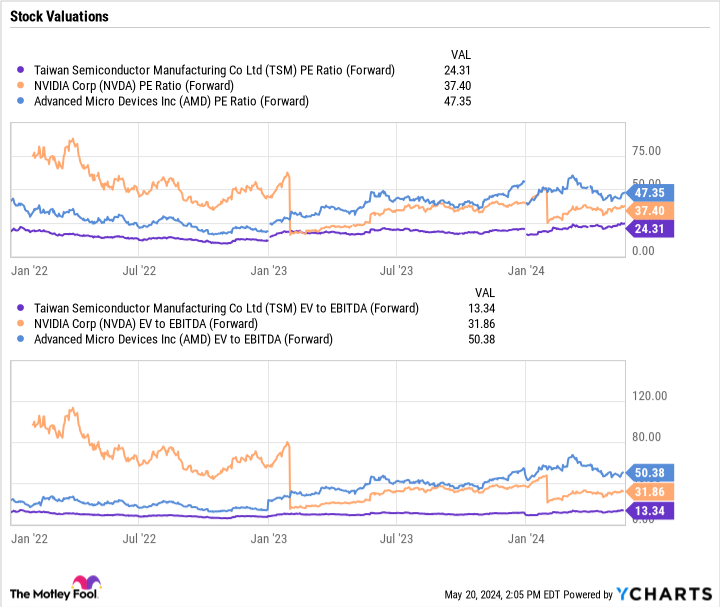

When looking at valuations, TSMC is the cheapest stock, trading at around 24 times P/E. It’s even cheaper on an enterprise value-to-EBITDA basis, trading at nearly 13 times. This metric takes into account its net debt position and excludes non-cash expenses.

TSM PE Ratio (Forward) data from YCharts

Meanwhile, Nvidia trades at a forward P/E of 37 and 32 on an EV/EBITDA basis. Given its growth, that’s a cheap valuation.

AMD is the most expensive stock of the group, trading at a forward P/E of over 47 and an EV/EBITDA multiple of over 50. However, the company has yet to see the potential AI chip inflection point that the other two companies have, so that it still has potential.

In order of preference at this point, Nvidia would be my first choice, closely followed by TSMC and then AMD. However, all three stocks have strong long-term potential.

John Mackey, former CEO of Whole Foods Market, a subsidiary of Amazon, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Microsoft, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long Jan 2026 $395 Microsoft calls and short Jan 2026 $405 Microsoft calls. The Motley Fool has a disclosure policy.